38+ Mortgage interest deduction calculator

For more information see Pub. How to refinance your mortgage.

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

How to use the calculator.

. 936 for more information about figuring the home mortgage interest deduction and the limits that may apply. Principal and interest on mortgage loan. 115-97 section 11043 limited the deduction for mortgage interest paid on home equity loans and line of credit.

Second mortgage types Lump sum. Form W-9 is a commonly used IRS form for providing necessary information to a person or company that will be making payments to another person or company. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3.

One of the most common situations is when someone works as an independent contractor for a business. Enter the data values separated by commas line breaks or spaces. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

Enter the details of the required number of intervals and click on the. Private lenders offer a range of interest rates which can be fixed or variable. For a conventional 30-year mortgage on a 200000 home assuming a 5 fixed interest rate total interest payments equal slightly more than 186000 in addition to the principal balance.

Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. 15 yr jumbo fixed mtg refi. 38 Business basis of building multiply line 37 by line 3 38.

1 the average discounted discretionary rate at the Big 6 banks as tracked by Butler Mortgage 2 the average broker rate as tracked by MortgageDashboardca and 3 the lowest conventional full-featured 5-year fixed rate at Butler Mortgage as of March 14 2017. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021. Include in column b of line 6 the amount of deductible mortgage interest figured in Step 1 that is attributable to the home in which you conducted the.

Such as mortgage interest charitable contributions medical and dental expenses and state taxes. Fifth Third and Fifth Third Bank are registered service marks. Guide to cash-out refinancing.

To use our calculator simply. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. Todays average rate on a 30-year fixed mortgage is 603 up 011 from the previous week.

With the use of our Dividend Tax Calculator you are able to discover how much income tax you will be paying with the input of your current salary and the annual dividend payments that you make. The initial interest rates are normally 05 to 2 lower than FRM with the same loan term. Lauren cant claim a deduction either because she received a benefit equal to the amount of her payment.

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. It is a comparison of the average advertised Big 6 bank special offer rate versus. Section 179 deduction dollar limits.

The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. You can use this grouped frequency distribution calculator to identify the class interval or width and subsequently generate a grouped frequency table to represent the data. Line 20Bb is the same figure.

Mandy cant claim a deduction because of the partial interest rule. Mortgage loan basics Basic concepts and legal regulation. If your total itemized deductions are less than the standard deduction the calculator will use the standard.

Free Bankruptcy Means Test Calculator for your State and County. Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

This will be the only land payment calculator that you will ever need whether you want to calculate payments for residential or commercial lands. Applies all IRS Expense allowances and current State Median Income standards to give you an idea of whether you qualify for Chapter 7 bankruptcy. The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018 PubL.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Second mortgages come in two main forms home equity loans and home equity lines of credit. 11597 text is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act TCJA that amended the Internal Revenue Code of 1986Major elements of the changes include reducing tax rates for.

Savings is over five years. An MMM-Recommended Bonus as of August 2021. 71 ARM refi.

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. Borrowers may be able to save on interest costs by going with a 15-year fixed mortgage as they. There are a number of additional expenses to add on top of your mortgage principal and.

For most filers the deduction is 2200. 1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and. The standard deduction in Arkansas is lower than the federal standard deduction.

Contact a mortgage specialist at Fifth Third Bank to learn about mortgages current mortgage rates and loan types. When you are hired as a contractor for a business or beginning work as a freelancer you may be. At the auction the church received and accepted a bid from Lauren Green equal to the fair rental value of the home for 1 week.

Use SmartAssets free New Jersey mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. If your total itemized deductions. Itemized deductions in Arkansas are similar to itemized deductions allowed by the IRS.

The period for which a loan is allocated to a particular use begins on the date the proceeds are used and ends on the earlier of the following dates. National Association 38 Fountain Square Plaza Cincinnati OH 45263 NMLS 403245 Equal Housing Lender. This calculator has been updated for the 2022-23 tax year.

See Contributions From Which You Benefit. Mortgage interest rates are normally expressed in Annual Percentage Rate APR sometimes called. For example real estate taxes charitable contributions mortgage interest and investment interest are all deductible.

Mortgage Interest Tax. You expect interest rates to remain stable or decline.

Goodwill Donation Values Spreadsheet Personal Financial Statement Financial Statement Statement Template

Use The Interactive Online Emi Calculator To Calculate Your Home Loan Emi Get All Details On Inter Life Insurance Premium Life Insurance Calculator Income Tax

Form 11 Mortgage Interest Deduction Understand The Background Of Form 11 Mortgage Interest D Irs Tax Forms Mortgage Interest Irs Taxes

Free Business Expense Spreadsheet And Self Employed Business Tax Deduction Sheet A Success Of Your Business Tax Deductions Business Tax Tax Deductions

Sole Proprietor Vs S Corporation In 2019 S Corporation Sole Proprietor Payroll Taxes

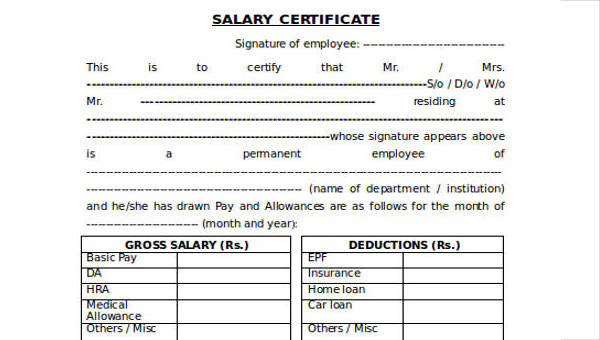

Free 38 Certificate Forms In Ms Word

Tax Day Freebies List 2012 Free Panda Express More Tax Write Offs Tax Deductions Business Tax

Home Loan Tax Deduction Home Loans Tax Tax Deductions

2020 2021 Tax Estimate Spreadsheet Higher Order Thinking Skills Interactive Lesson Plans Student Orientation

Pin On Id Card Template

Home Loan Home Loans Debt Relief Programs Home Improvement Loans

Home Business Worksheet Template Business Worksheet Business Tax Deductions Home Business

Payroll Calculator Template Free Payroll Template Payroll Templates

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

What Is A Schumer Box And How Do You Read It Nerdwallet Good Credit Best Credit Cards Reading

Real Estate Lead Tracking Spreadsheet

Cheat Sheet Of 100 Legal Tax Deductions For Real Estate Agents Real Estate Agent Real Estate Deduction